The company is working towards a future where autonomous vehicles will be safe to use on roads worldwide. Innoviz is an Israeli company that specializes in LiDAR technology and is a leader in the global market.

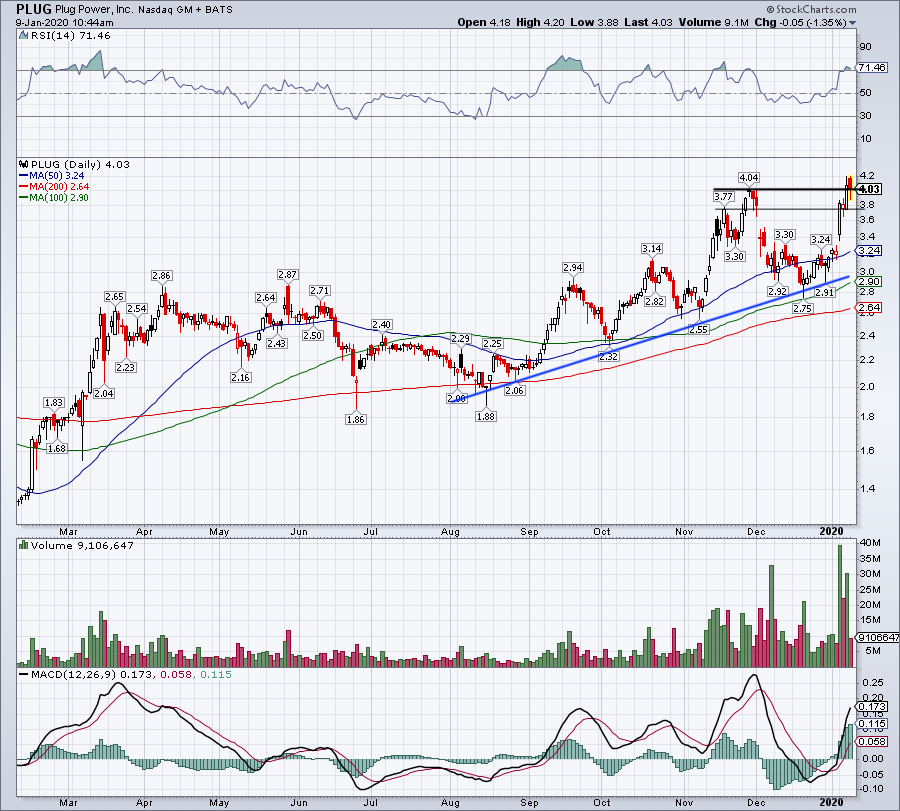

Meanwhile, an alternative company operating in the EV space is Innoviz Technologies Ltd. Compared to the sector-wide benchmark of 1.6, this is 340% higher, indicating that the stock may offer less value compared to other companies in the same sector.Īnother key metric to look at is a company's price-to-book value (P/BV), which tells us how much investors are willing to pay for a company's assets.īased on its most recent financials, Plug Power Inc's P/BV is 1.2, and this is 50% lower than the average across the industry, which is 2.4. Plug Power Inc's P/S ratio is currently 7. Next, let's look at one of the most common valuation metrics - the P/S ratio. These products will serve as a substantial source of recurring revenue for the company and clearly demonstrate the path to profitability for all investors. By the end of 2023, Plug aims to generate $1.4 billion in revenue, commission a 200-ton liquid green hydrogen plant, become the largest global player, exceed $400 million in electrolyzer sales, and deploy 30 megawatts of stationary power products. It also believes the favorable business environment for sustainable solutions will benefit all PLUG stakeholders. Despite some doubters, the company is confident that its 4,000 global employees and partnerships can achieve their ambitious goals. Plug Power prioritizes large-scale manufacturing to accelerate business growth and drive profitability. The company is on a mission to reach profitability, but that goal is still a while off. As it's not yet a profitable company, its EPS is negative. Based on its last reported balance sheet, Plug Power Inc's EPS is -1.25 for fiscal year 2022. EPS is the first metric we'll look at, and this is used by investors to gauge the profitability of a company on a 'per share' basis. Let’s analyze whether Plug Power stock has potential or if it’s one to avoid. Over the past year, the stock is down by -62%, whilst the S&P 500 is down by -3%, meaning the stock has performed worse than the broader market by approximately -59% over this period. PLUG Stock OverviewĪs of, the company's stock is trading at $8.47, and year-to-date (YTD), it is down by -30%. These facilities are expected to yield 500 tons of liquid green hydrogen daily by 2025.

To support this expansion, Plug is building a state-of-the-art Gigafactory to produce electrolyzers and fuel cells, along with multiple green hydrogen production plants. The company plans to expand its operations by building a green hydrogen highway across North America and Europe. Plug has already deployed more than 60,000 fuel cell systems and over 200 fueling stations, making it the largest buyer of liquid hydrogen and the leader in the industry. The company is working to create a sustainable market for hydrogen fuel cell technology that spans production, storage, and delivery to energy generation. Plug Power Inc ( NASDAQ: PLUG) is focused on building a complete green hydrogen ecosystem.

0 kommentar(er)

0 kommentar(er)